Mehiläinen’s financial year 2025: A year of international expansion

Press Release, February 11, 2026

2025 was a year of strong international growth and significant new openings for Mehiläinen. The company expanded into three new countries, while continuing profitable growth across all business areas.

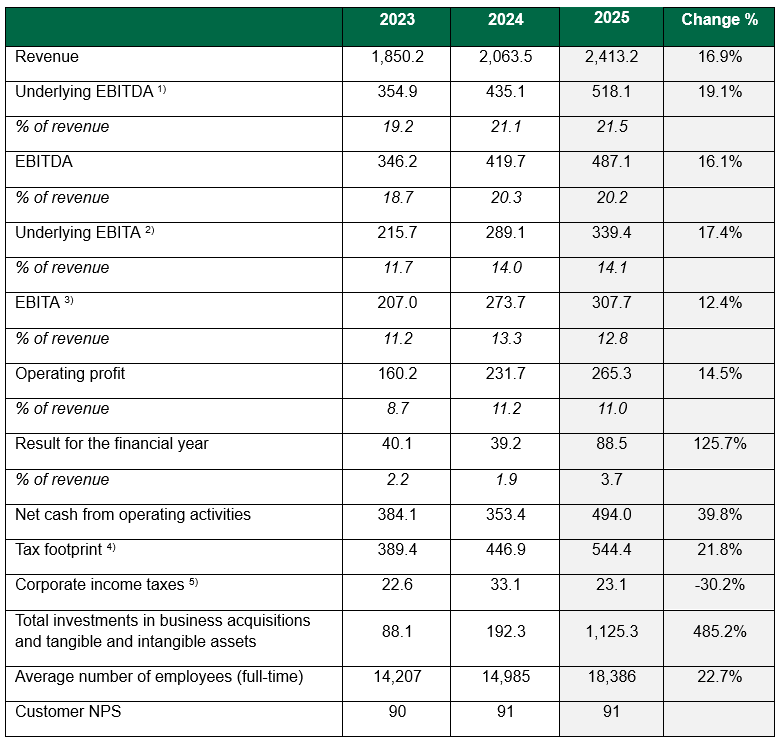

Mehiläinen’s revenue for 2025 increased by 16.9% from the previous year to EUR 2,413.2 (2,063.5) million. Growth was strong in all operating countries and across different business areas. In the first half of the year, Mehiläinen expanded into Lithuania with the acquisition of InMedica Group, and by the end of the year, acquisitions were concluded for healthcare companies Regina Maria in Romania and MediGroup in Serbia.

As part of the acquisitions, Mehiläinen's ownership base also strengthened, with private equity firm Hellman & Friedman making a significant investment in the Group and becoming the second main shareholder alongside CVC. Mehiläinen’s management and personnel continue to be part of the ownership structure, alongside Finnish institutional investors Varma, the State Pension Fund of Finland, Ilmarinen, Pharmacy Pension Fund, and Valion Eläkekassa Pension Fund. The company also financed key acquisitions by issuing bonds worth 1.09 billion euros, in addition to equity investments made by the owners.

– During 2025, Mehiläinen became a truly international group and established its position as one of Europe's leading providers of integrated outpatient healthcare services. By the end of the year, we had 55,000 professionals in seven countries. I am also proud of the increased personnel ownership, which demonstrates the commitment to the firm and its entrepreneurial spirit, says Janne-Olli Järvenpää, CEO of Mehiläinen Group.

Mehiläinen’s underlying EBITA2) was EUR 339.4 (289.1) million, and the financial result for the year was EUR 88.5 (39.2) million, or approximately 3.7% of revenue. During the year, Mehiläinen made significant investments in expanding its service network in the fields of gynaecology, therapy services, dental health, and orthopaedics in multiple countries. In Finland, home care services and residential care services for the elderly grew organically and through acquisitions. Investments in facilities, digital development, medical devices, and other fixed assets grew by about 53% from the previous year to EUR 106.8 (69.8) million. Investments, including acquisitions, increased to EUR 1,125.3 (192.3) million. Mehiläinen’s tax footprint increased to EUR 544.4 (446.9) million during the year. Corporate income taxes amounted to EUR 23.1 (33.1) million.

Mehiläinen also systematically advanced its sustainability work during the year. The company published a new sustainability program that sets targets for 2030. These targets focus on Mehiläinen's most essential sustainability aspects: investments in high-quality care, climate-resilient social and healthcare, a thriving diverse community, as well as sustainable, secure business operations.

– Mehiläinen will continue to invest in facilities and in developing the IT infrastructure, as well as continue to seek value-adding acquisitions in the operating countries. We are also actively exploring opportunities to expand into new countries in the coming years. Our vision is to rewire European healthcare towards an outpatient oriented, value based, preventive, integrated and customer centric model powered by digital technologies, analytics and AI, Järvenpää states.

The 2025 Annual Report has been published on Mehiläinen's website. The year's key developments, sustainability themes, financial statements, and the Board of Directors' report are detailed within the document.

Key Figures

1) EBITDA before items affecting comparability.

2) Operating profit before the depreciation and amortisation of intangible assets arising from business acquisitions, impairments and items affecting comparability.

3) Operating profit before the depreciation and amortisation of intangible assets arising from business acquisitions and impairments.

4) Tax footprint, including employer contributions. The tax footprint of private practitioners operating at Mehiläinen, estimated at EUR 155.7 (142.0) million, is added to Mehiläinen’s tax footprint.

5) Corporate income taxes include all income taxes recognised in the result for the financial year and income taxes recognised during the financial year due to adjusted income for the previous financial years (not including deferred taxes). Corporate income taxes paid during the financial period amounted to EUR 30.7 (2024: 32.4, 2023: 15.6) million.