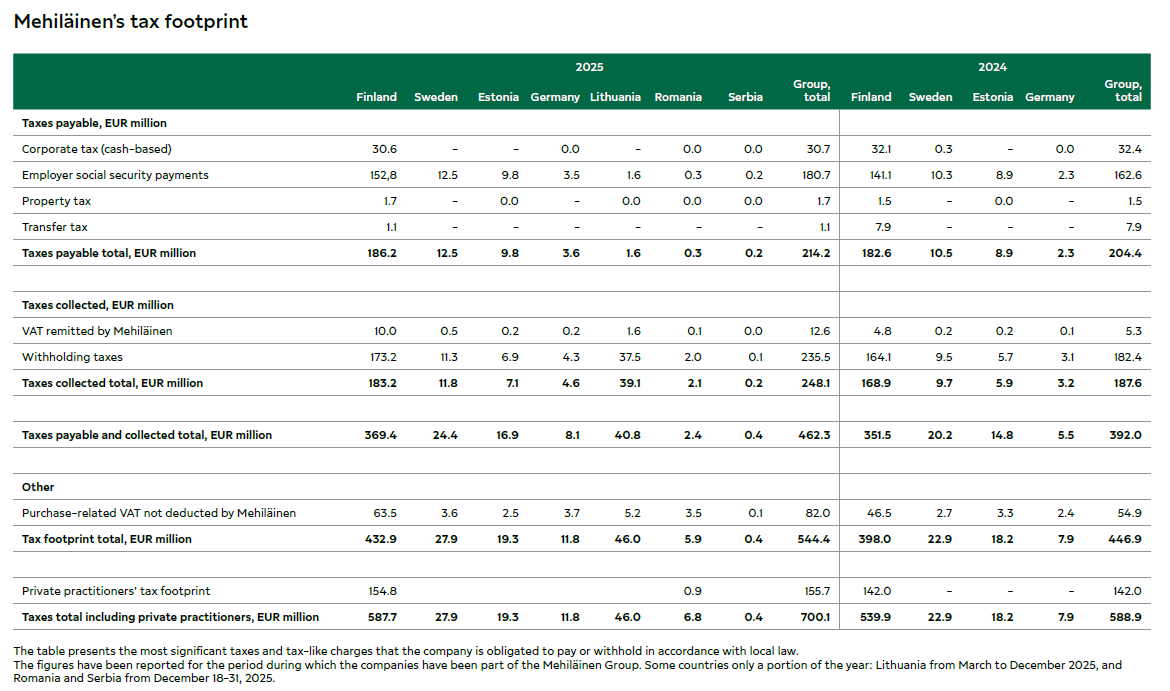

Mehiläinen’s tax footprint

The tax footprint indicates the impact of Mehiläinen on surrounding society as a payer of taxes and tax-like charges.

Mehiläinen’s goal is to pursue an open and transparent tax policy and to report its tax footprint annually. The tax footprint report is published as part of the sustainability report. The reporting describes the taxes paid and collected by the Group companies, as well as the distribution of activities in different countries. Regular tax reporting supports the transparency of taxation.

Mehiläinen’s tax footprint increased to EUR 544.4 (446.9) million during the year. Corporate income taxes amounted to EUR 23.1 (33.1) million.

Mehiläinen’s full tax footprint in 2025 consists of EUR 30.7 million in corporate taxes paid by the company (2024: 32.4), as well as non-deductible VAT of EUR 82.0 million paid on purchases and investments (2024: 54.9), EUR 12.6 million in VAT (2024: 5.3), EUR 180.7 million in employer contributions (2024: 162.6), EUR 235.5 million in taxes withheld from salaries (2024: 182,4), EUR 1.1 million in transfer taxes (2024: 7.9) and EUR 1.7 million in real estate taxes (2024: 1.5) paid by the company. In addition to the tax footprint, the private practitioners working at Mehiläinen pay taxes on the remuneration they receive from Mehiläinen, estimated at EUR 155.7 million (2024: 142.0).